The Single Strategy To Use For Mortgage Broker Vs Loan Officer

Wiki Article

Not known Factual Statements About Mortgage Broker Assistant Job Description

Table of ContentsFacts About Broker Mortgage Meaning RevealedFacts About Broker Mortgage Meaning RevealedMortgage Broker Assistant Job Description Fundamentals ExplainedNot known Incorrect Statements About Mortgage Broker Job Description Mortgage Broker Average Salary - QuestionsMore About Broker Mortgage FeesExamine This Report about Broker Mortgage FeesMortgage Broker Can Be Fun For Everyone

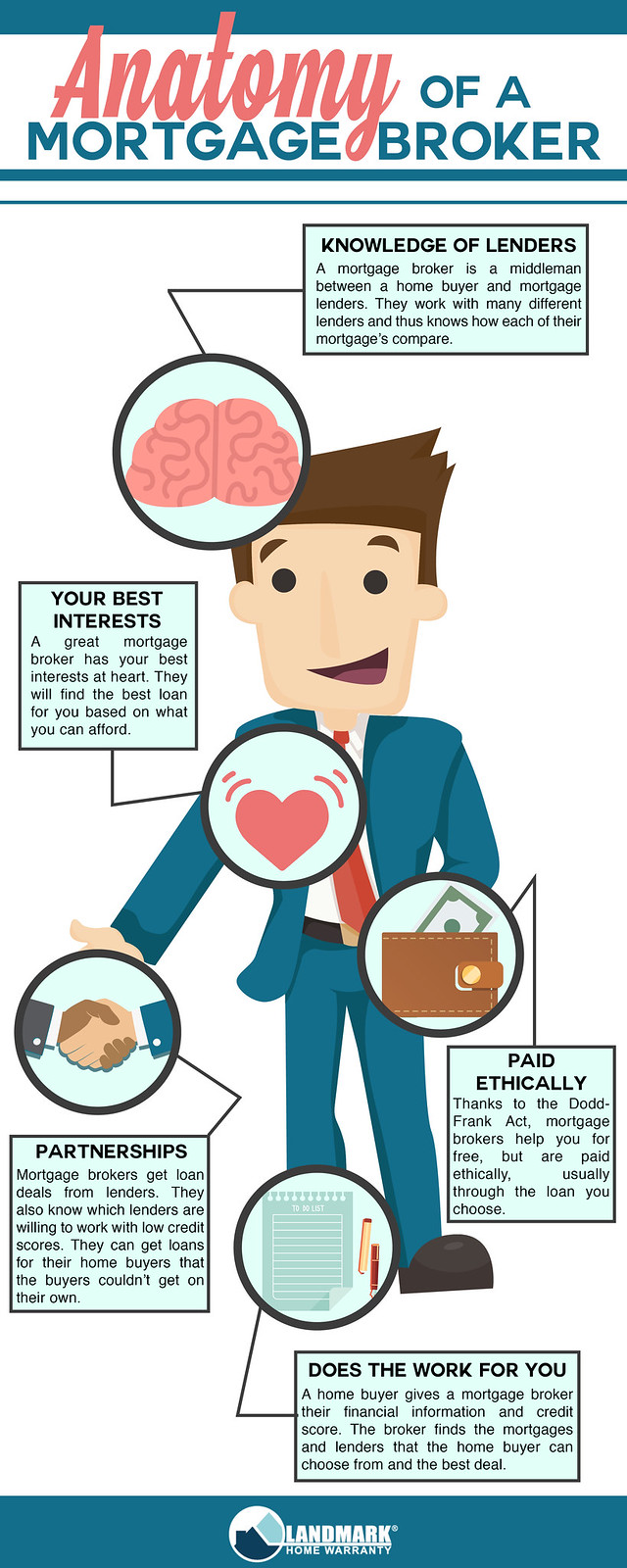

What Is a Home mortgage Broker? The home mortgage broker will certainly work with both events to get the private approved for the funding.A home loan broker normally works with many various lenders as well as can use a selection of funding choices to the borrower they function with. The broker will gather details from the private as well as go to numerous loan providers in order to find the ideal possible funding for their client.

How Mortgage Broker Job Description can Save You Time, Stress, and Money.

The Base Line: Do I Required A Home Loan Broker? Collaborating with a mortgage broker can conserve the customer time as well as initiative throughout the application procedure, as well as possibly a lot of money over the life of the car loan. Furthermore, some loan providers function specifically with home loan brokers, indicating that debtors would have access to car loans that would certainly or else not be offered to them.It's vital to analyze all the fees, both those you may have to pay the broker, along with any type of costs the broker can aid you prevent, when considering the choice to collaborate with a mortgage broker.

Top Guidelines Of Broker Mortgage Meaning

You've possibly heard the term "home loan broker" from your property representative or friends who have actually bought a house. What precisely is a mortgage broker and also what does one do that's different from, claim, a finance police officer at a financial institution? Geek, Purse Overview to COVID-19Get responses to inquiries about your mortgage, traveling, funds as well as preserving your satisfaction.What is a home mortgage broker? A home loan broker acts as a middleman in between you and possible lending institutions. Home mortgage brokers have stables of loan providers they function with, which can make your life easier.

About Mortgage Broker Assistant Job Description

Just how does a home loan broker get paid? Mortgage brokers are most usually paid by lenders, often by consumers, but, by regulation, never both.The competition and also residence rates in your market will contribute to dictating what home mortgage brokers fee. Federal legislation restricts how high compensation can go. 3. What makes home mortgage brokers different from loan officers? Finance police officers are workers of one lending institution that are paid set salaries (plus rewards). Loan police officers can compose only the kinds of fundings their company selects to use.

Not known Facts About Mortgage Broker Meaning

Mortgage brokers might be able to give consumers access to a wide choice of loan types. 4. Is a mortgage broker right for me? You can conserve time by making use of a home loan broker; it can take hours to look for preapproval with different lending institutions, then there's the back-and-forth communication involved in financing the lending and guaranteeing the purchase remains on track.When picking any type of lender broker mortgage rates whether with a broker or straight you'll want to pay attention to lender fees. Particularly, ask what fees will show up on Page 2 of your Finance Quote type in the Loan Costs area under "A: Source Charges." After that, take the Finance Estimate you obtain from each lender, place them side-by-side and compare your rate of interest price and all of the costs as well as shutting expenses.

Little Known Facts About Broker Mortgage Near Me.

5. How do I select a home loan broker? The finest way is to ask mortgage broker jobs good friends and family members for recommendations, but ensure they have really utilized the broker and aren't simply going down the name of a former college flatmate or a far-off colleague. Find out all you can about the broker's services, interaction design, degree of expertise as well as strategy to clients.

Unknown Facts About Mortgage Broker Salary

Competitors as well as house rates will certainly influence exactly how much home loan brokers make money. What's the distinction in between a mortgage broker and a financing policeman? Mortgage brokers will certainly collaborate with several lenders to discover the very best car loan for your circumstance. Funding policemans benefit one lender. Just how do I find a home mortgage broker? The best way to locate a mortgage broker is via references from family, good friends as well as your realty representative.

Our Mortgage Broker Meaning Statements

Buying a brand-new house is one of the most intricate occasions in an individual's life. Feature vary substantially in terms of style, amenities, school district as well as, obviously, the always crucial "area, place, place." The mortgage application process is a complicated element of the homebuying procedure, specifically for those without past experience.

Can identify which problems might create difficulties with one lending institution versus an additional. Why some customers stay clear of home mortgage brokers Sometimes property buyers really feel more comfy going straight to a large bank to secure their loan. In that situation, customers should at least talk to a broker in order to look at this now comprehend all of their options regarding the kind of loan as well as the readily available rate.

Report this wiki page